Industry News

October 2023 Housing Report

October saw continued decreases in the housing market in Fort Worth, with the median price, number of active listings, and number of closed sales all down year over year. The median Fort Worth home price was $330,000.

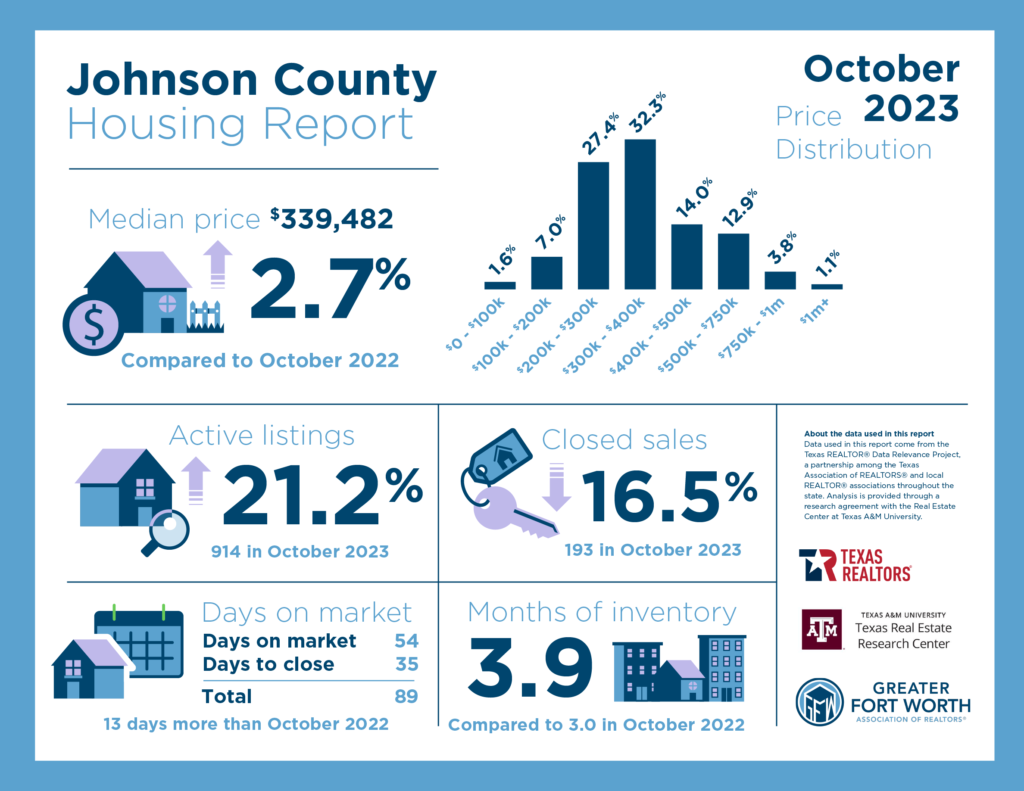

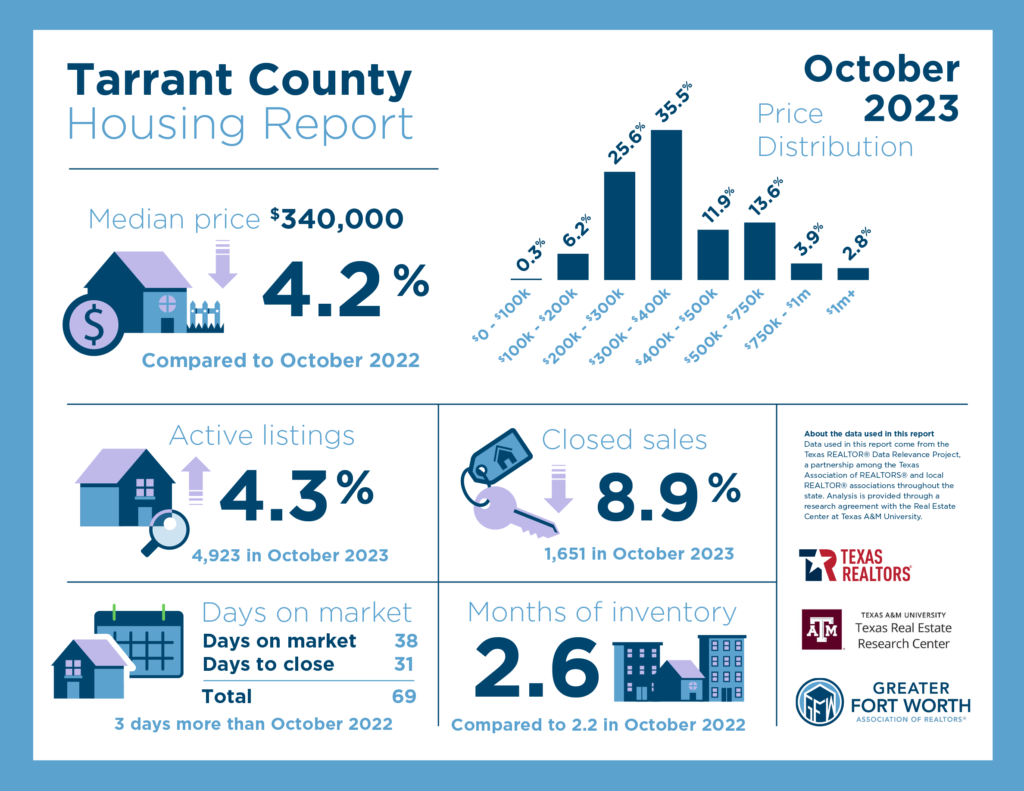

The only increase in Fort Worth was in inventory. At 2.6 months in both Fort Worth and Tarrant County, inventory continued a slow but steady climb. The Texas Real Estate Research Center at Texas A&M University states that 6.5 months of inventory would represent a balanced market, so more homes are still needed to meet demand.

This week, the rate for 30-year fixed-rate mortgages, which had been sitting near 8 percent, fell a quarter of a percent to 7.5 percent according to Freddie Mac. Whether this is a sign of things to come is yet to be seen, but affordability continues to be the biggest hurdle for homebuyers.

“There’s less competition right now, because everyone is still waiting for the interest rates to come back down,” said Bart Calahan, 2023 President of the Greater Fort Worth Association of REALTORS®. “My advice is to take advantage of the current market conditions and do so with the expertise of a REALTOR®, which will be key to navigating shifting rates and limited inventory.”

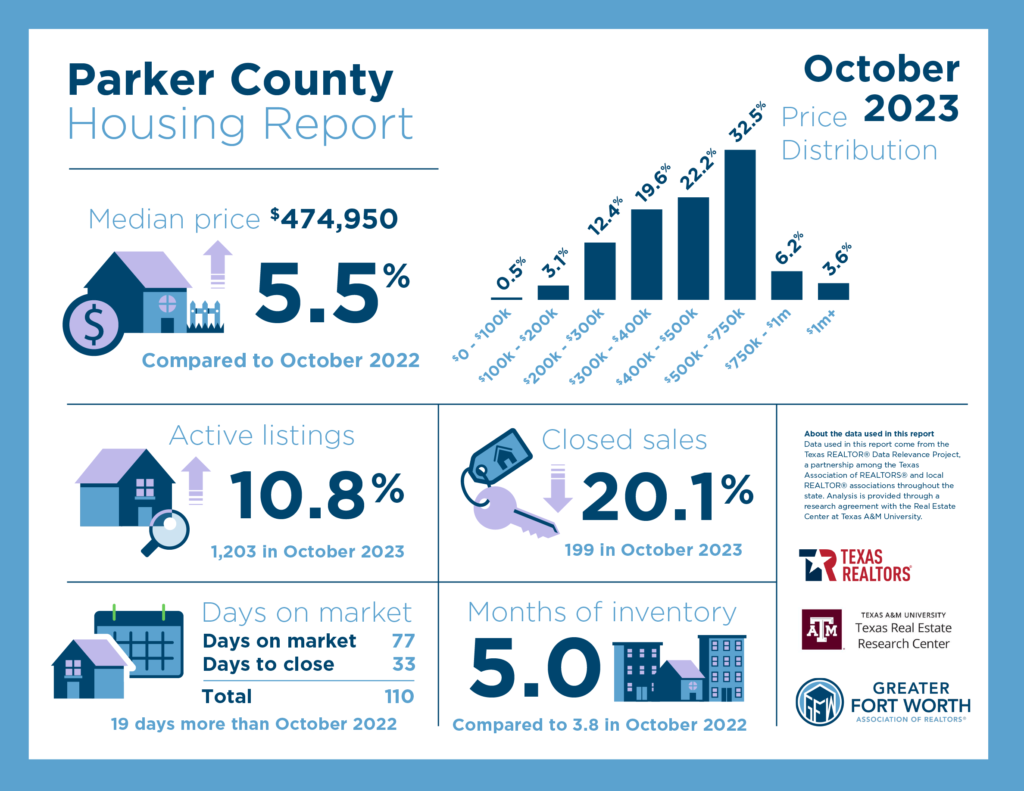

Although active listings were down year over year in Fort Worth, those numbers were up in Tarrant, Johnson, and Parker Counties as inventory increased across the board. The median home price in Tarrant County was $340,000 – the lowest it has been since March.

While mortgage rates have had a cooling effect on the market, days on the market have stayed at around 38 days, creating an opportunity for homebuyers to potentially avoid multiple offer situations and negotiate a good price for a home. Refinancing later is always an option for the homebuyer who can take advantage of these opportunities, rather than wait for mortgage rates to fall.

“With consumer inflation becoming more manageable, the Federal Reserve needs to consider cutting interest rates,” said National Association of REALTORS® Chief Economist Lawrence Yun. “In turn, Congress must consider incentives to boost housing supply and inventory so that more Americans can participate in wealth accumulation. The housing market shouldn’t be accessible only to those who are paying in cash nor become a playground for the wealthy.”

October 2023 Statistics At-A-Glance…